This article first appeared on the Polkadot blog

The potential of Web3 extends well beyond reshaping finance in the developed world — it can also be used to foster greater financial inclusion in developing regions and new forms of democratic decision-making. But to allow for greater adoption, the fees to access Web3 services must be linked to local purchasing power. Furthermore, additional voting mechanisms beyond coin voting are needed that operate on the principle of one person, one vote. These considerations pose unique technical challenges for decentralized networks, which Encointer seeks to address.

Introduction

In the blockchain space, it can seem that everything is new and unparalleled.

But if you take a step back, the ownership and control of decentralized systems now is not that dissimilar to systems of the past. In England in the early 18th Century, for instance, it was argued that only those with a physical stake in the country should be granted influence. Following this reasoning, voting was largely restricted to citizens who owned land, while a class of large landowners known as landed gentry dominated the parliament.

Later, as Britain grew and agriculture became less important, a new system was needed. It became accepted that if somebody is affected by the laws of a country, they should have some decision-making power, regardless of whether they own land (see the Putney Debates).

Fast forward to today, and not all decisions in the UK are made democratically. For instance, if you own shares in a company, this entitles you to exercise voting rights not open to other citizens. If you live in London, you cannot vote in Scottish parliamentary elections. But questions that concern the laws of the land and the overall “rules of the game” are subject to democratic oversight with universal suffrage.

For the most part, Web3 remains a nascent concept that has yet to fully mature. During this building phase, while trying to scale and drive adoption, many decisions about architecture and system design have been driven by pragmatic technical considerations. But if Web3 services are to become globally relevant within the next decade, we must prepare the groundwork for this transition. In this regard, we need to ask hard questions about how fees and governance mechanisms affect the inclusiveness of Web3 services and decentralized decision-making processes.

Web3 Faces an Inclusion Problem

Web3 services are often heralded as a potential driver of financial inclusion in the developing world. It’s easy to see why this is such an exciting idea. Take remittances, for instance: payments sent by migrant workers to households in their country of origin. Such payments form a vital lifeline for families in low and middle-income countries, amounting to triple the volume of official development aid and, outside China, 50% more than foreign direct investment. But these payments are subject to exorbitant fees, with the poorest regions hit hardest. For example, the average cost of sending a $200 remittance across international borders globally is 6.4%, while the average cost of sending the same sum to Sub Saharan Africa is 8%. Furthermore, research indicates that remittances sent through digital channels tend to cost less than those sent through banks. This would all seem to suggest that decentralized, peer-to-peer digital payments could play an important role.

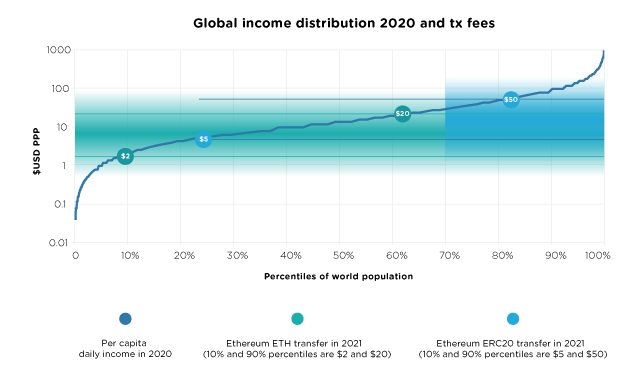

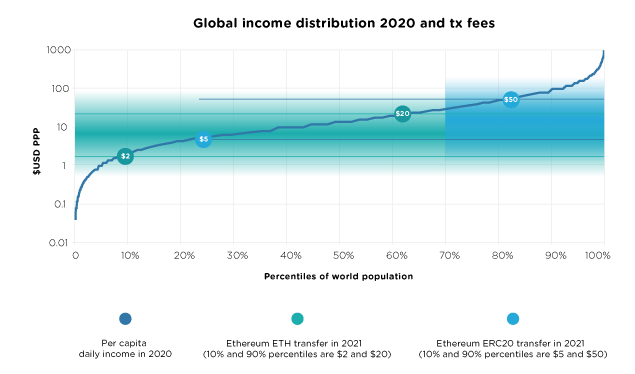

But Web3 financial services face their own barriers to inclusion. Most networks adopt a “pay-as-you-go” model, involving transaction fees designed to prevent spam and prioritize traffic at times when the network is congested. While there are many good reasons to levy fees in terms of game-theory, they pose a major obstacle in developing regions. Take Ethereum, for example: the above graph makes the plausible assumption that the fees for a pure ETH transfer fall in a range of between $2 and $20 (green), while fees fees for an ERC20 transfer range between $5 and $50 (blue). The curve illustrates per capita daily income globally. At $20, 60% of the global population earn less per day than the cost of a single transaction. While the fee structure on Polkadot is not directly comparable with Ethereum, the network is faced with similar barriers to inclusion. And remember that this just considers total daily income — it doesn’t even begin to account for essential expenses like food, shelter, light and heat.

Adjusting Fees to Purchasing Power

Thus, to promote genuine financial inclusion, Web3 services need to find ways to onboard people with less means. A key issue here is that currently, fees are not adjusted to purchasing power. Cryptocurrencies are traded globally, so ETH or DOT will cost just as much to buy in Nigeria as they do in Switzerland.

This is where the flexible structure of the Polkadot network, which combines pooled security with customizable parachains, poses exciting opportunities. Localized Web3 financial services could emerge which can charge fees adjusted to purchasing power by issuing localized tokens. Encointer has created a framework that enables any geographically concentrated group of people to create, distribute and use their own digital community currency. Such a currency can be distributed regularly to active participants at no cost, functioning akin to universal basic income, but with no government involvement required. This could foster local economic activity in communities where individuals have skills and products to sell, but lack the money to trade them. Furthermore, by providing a way to pay fees in a token adjusted to local purchasing power, it could act as a first stepping stone to greater adoption of Web3 services in developing countries and emerging markets.

The Hard Problem: How Encointer Resists Sybil Attacks

But for such a system to work, we need to confront a problem. In a public, unpermissioned network, anyone can join, ensuring accessibility and pseudonymity. But there’s a catch: if anyone can join and everyone is pseudonymous, anyone can join multiple times. This leads to undesirable consequences. For example, an individual could receive their allocation of a digital community currency many times under numerous identities. Creating a “unique identity system” or unique proof of personhood is regarded as one of the hard problems of decentralized systems by Vitalik Buterin.

To address this challenge, Encointer takes a novel approach. The protocol stipulates that every participant needs to be willing to prove their personhood at physical key-signing events. Such events are held at regular intervals, take place simultaneously throughout the globe, and involve a randomized gathering of participants at random locations within the agreed geographic boundaries of each community. This requirement to prove personhood and location makes Encointer more secure, ensuring that when a majority of a community is honest, a Sybil attack is not possible. Although key signings take place in person, however, the protocol also involves numerous mechanisms to protect the privacy of users, which is highly important if you can only maintain a single unique identity.

For developing communities, Encointer opens up interesting possibilities. By creating a decentralized, unique identity system that is not reliant on any central authority, it could broaden access to Web3 services. In the current climate where most new users rely on cryptocurrency exchanges to access decentralized services, a state-issued ID would be essential to pass Know Your Customer (KYC) requirements, thereby excluding almost one billion humans. Encointer provides a robust alternative. Furthermore, by creating localized tokens geared to the purchasing power of communities, Web3 services with fees tailored to the income levels of users can be developed.

From Financial Inclusion to Democratization

At its current stage of development, decision-making mechanisms like coin voting and coin nomination are suited to most Web3 applications. For the governance of decentralized autonomous organizations (DAO), for example, staking will always be appropriate and is somewhat akin to exercising your rights as a shareholder in traditional finance.

However, as the barriers to access fall and adoption grows, it will be important in the longer term to complement coin voting with mechanisms that operate on the principle of one person, one vote. The precise delineation of which decisions should be made by coin voting and which by equal representation will need careful consideration and are beyond the scope of this article, but the following arguments point to the need for democratic options:

- Economic rationale: In the long run, coin voting could become problematic if it means that wealthy incumbents can set the rules of the game in their own favor. Such an oligopoly would ultimately create an uneven playing field that hinders innovation. Indeed, this is precisely the type of institutional inertia that decentralized systems were supposed to challenge.

- Ethical rationale: Financial might is not always right. For reputation systems to work effectively, for example, democratic voting mechanisms may be preferable.

Ultimately, principles like universal suffrage and one person, one vote are cornerstones of any legitimate democracy. In the long run, as proponents of Web3, we cannot claim to be “democratizing finance” or “democratizing the web” unless we incorporate these principles into our governance structures. By enabling users to prove their unique personhood while preserving their privacy, the Encointer protocol has laid some of the groundwork in this endeavor. Based on the existing coin-voting procedure, Encointer was granted a common good parachain slot on Polkadot’s canary network Kusama, successfully onboarding on January 9th. The first real-world currency communities will be bootstrapped throughout 2022, which will garner data and experience to test and refine the protocol.

Conclusion

Web3 services face a fundamental barrier to inclusion: the value of the tokens needed to execute transactions are set according to global supply and demand and are not adjusted to local purchasing power in developing nations. As a result, the vast majority of the world’s population is excluded. By creating a framework for the formation of voluntary, local, digital community currencies, adjusted to local economic conditions, Encointer seeks to broaden access to Web3.

In addition, by enabling users to maintain and validate a unique proof of personhood, Encointer could enable existing decision-making mechanisms like coin voting to be complemented by more democratic instruments based on one person, one vote.