The research is clear — when women gain and maintain more control over their finances, it results in economies which are more resilient, diverse and equal. But how can we move beyond this macro insight to drive change in local communities? In this post, we discuss the barriers and enablers of female economic empowerment and how Encointer could help.

Men splurge, women invest: the truth about female economic empowerment

Cliches about women going on shopping sprees and having wardrobes full of shoes are common, but research tells a different story. So men, you might want to take note – a wide range of studies from developing countries like Bangladesh and Haiti, to developed nations like the United States have all come to the same conclusion: women tend to be more prudent budgeters than men, directing more household income towards things like food, education, and long-term durable goods.

Female economic empowerment is a term that you’ve probably seen mentioned before in articles or conference presentations. But what does it mean exactly? In any market-based economy, an individual’s ability to make independent decisions tends to be closely tied to their financial resources. You might be a talented craftsperson who always dreamed of starting your own business, but unless you can access money and control how it is spent, it will be highly challenging to bring your idea to fruition. Female economic empowerment occurs when women receive an income that they can control independently and use for priorities that are important to them.

Female empowerment benefits everyone

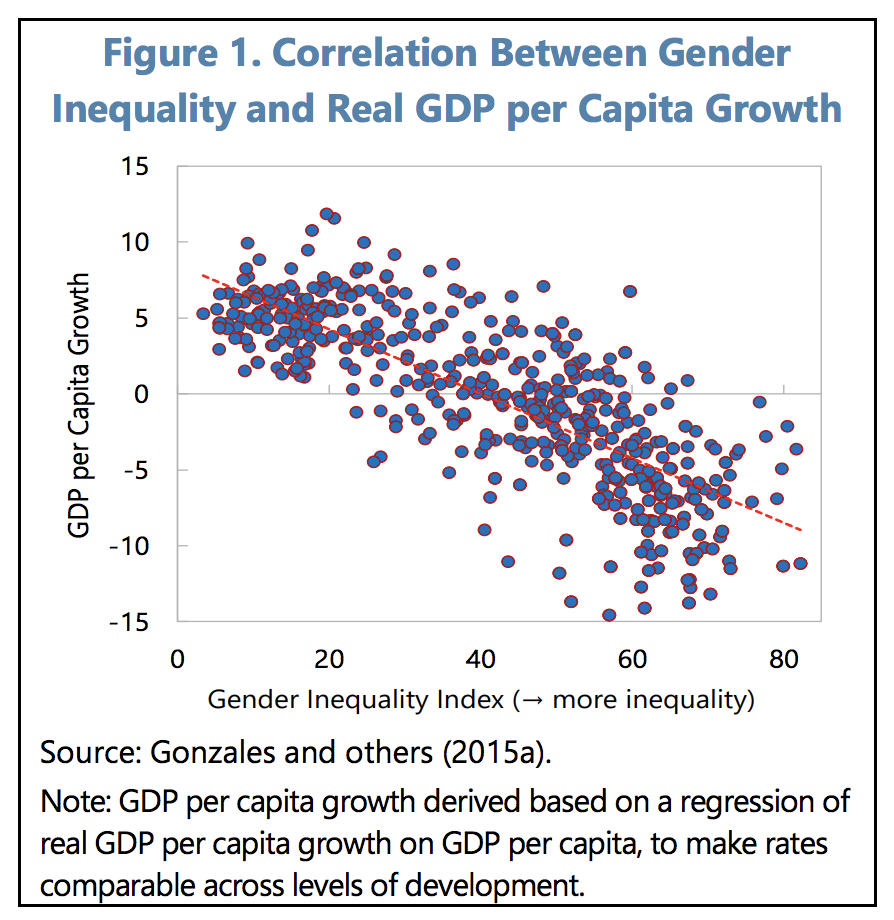

When women get more economic opportunities, it is not only beneficial for the women involved. In fact, many studies have linked empowerment with numerous macro benefits including higher economic growth, lower social inequality, and higher resilience to shocks.

The first advantage is intuitive. When women have more access to work, this expands the size of the labor force and increases GDP. Studies by IMF staff indicate that developed countries like Canada or Japan could increase their GDP by 4% by bridging the gender gap. But the potential in developing nations is much greater, with countries like Niger or Pakistan standing to reap a 30% boost in GDP by realizing the full economic potential of their female populations.

But while it seems obvious and tautological to say “when more women work, the economy grows,” there are more subtle factors at play. Remember that economic empowerment is not just about receiving an income — it also entails the freedom to decide how it is spent. And it stands to reason that if women have more control over the income they receive, they have a greater incentive to work in the first place.

When women are economically empowered, it reduces inequality, which in turn has been linked with more sustainable economic development. Whereas unequal societies tend to experience erratic growth, those with greater equality tend to experience more even, sustained growth over time. In addition, when women have greater control over financial resources, more of it is typically invested in education for children, food and long-term durable goods, which also fosters longer term economic development.

Finally, economies with large gender gaps are typically concentrated in a more narrow range of industries, particularly commodities. Conversely, when more women enter the workforce, the sectoral diversity of the economy increases, making it more resilient to shocks such as commodity price changes or downturns in a particular industry.

What’s blocking female economic empowerment?

So given all the benefits female empowerment has to offer, what’s holding back progress? Some of the classical explanations of gender gaps still apply. Women are more likely to be primary homemakers and caregivers, reducing the amount of time they can dedicate to a job or business.

A related and oft overlooked issue is that the power dynamics within families can hinder female economic independence. Oftentimes, even when women can find gainful employment or access to credit, these financial resources become controlled by other family members for other purposes, reducing their developmental benefits.

For example, studies in India, Ghana and Sri Lanka showed that profits increased when female entrepreneurs in a single-business household received grants or loans. Conversely, these additional resources had a far lower impact if the women lived in households with multiple business owners, suggesting that the funds were being diverted by family members to other businesses.

This leads to an important finding. When women have direct access to their financial resources through separate bank accounts, savings accounts or mobile payment apps, they can exercise more economic independence.

How Encointer fits in

Our platform enables communities everywhere to establish secure and inclusive digital community currencies. Once a community currency has been established, any individual can participate in an Encointer gathering and receive a community income on their smartphone, even if they don’t have access to local employment networks.

This could serve as a way to receive an income, while bypassing potentially restrictive social hierarchies. For instance, Encointer could enable communities of women to start producing and trading goods without needing support from traditional financial institutions. This could help bootstrap female-run businesses initially, which may go on to receive funding from traditional financial institutions in the long term once their viability has been demonstrated.

In addition to providing an income, Encointer also helps to ensure greater financial independence. As mentioned previously, additional resources have limited developmental benefits unless women can control how they are spent. By design, Encointer’s protocol ensures that each participant has a separate account. Furthermore, each account is secured in the Encointer wallet app by a user-generated PIN, as well as any in-built security features that prevent the smartphone being unlocked by an unauthorized user. This could help women exercise more control over their community income than schemes where funds are paid in cash or into shared accounts.

By providing women with a secure, independent income, Encointer can potentially provide women with a greater incentive to engage in the local economy and help to spur greater female economic empowerment.