One of the big milestones of 2022 for Encointer was the launch of Leu Zurich, which became the first fully operational community currency based on our platform. It has since been joined by another active community currency in Kigali, Rwanda, and local teams in Green Bay, Wisconsin and Berlin, Germany are also laying the groundwork for forthcoming launches. But Leu still holds the title of being the longest established Encointer currency.

Since the first key-signing gathering in May, Leu has made encouraging progress. 143 participants have already taken part in at least one gathering and there are 780 accounts with a positive balance. An eclectic and vibrant network of participating retailers has formed encompassing 7 local businesses which now accept the currency in Zurich’s city center. In addition, Leu has also been accepted at cultural events such as this year’s Openair Wipkingen.

But beneath these high-level figures, what does the more granular picture look like? How many people attend Leu gatherings? How many transactions have there been? How big is the money supply and how fast has it grown over time? This blog takes a look at some of the key statistical trends that illustrate the development of Leu over the past 7 months since its launch.

Participation at Leu Gatherings

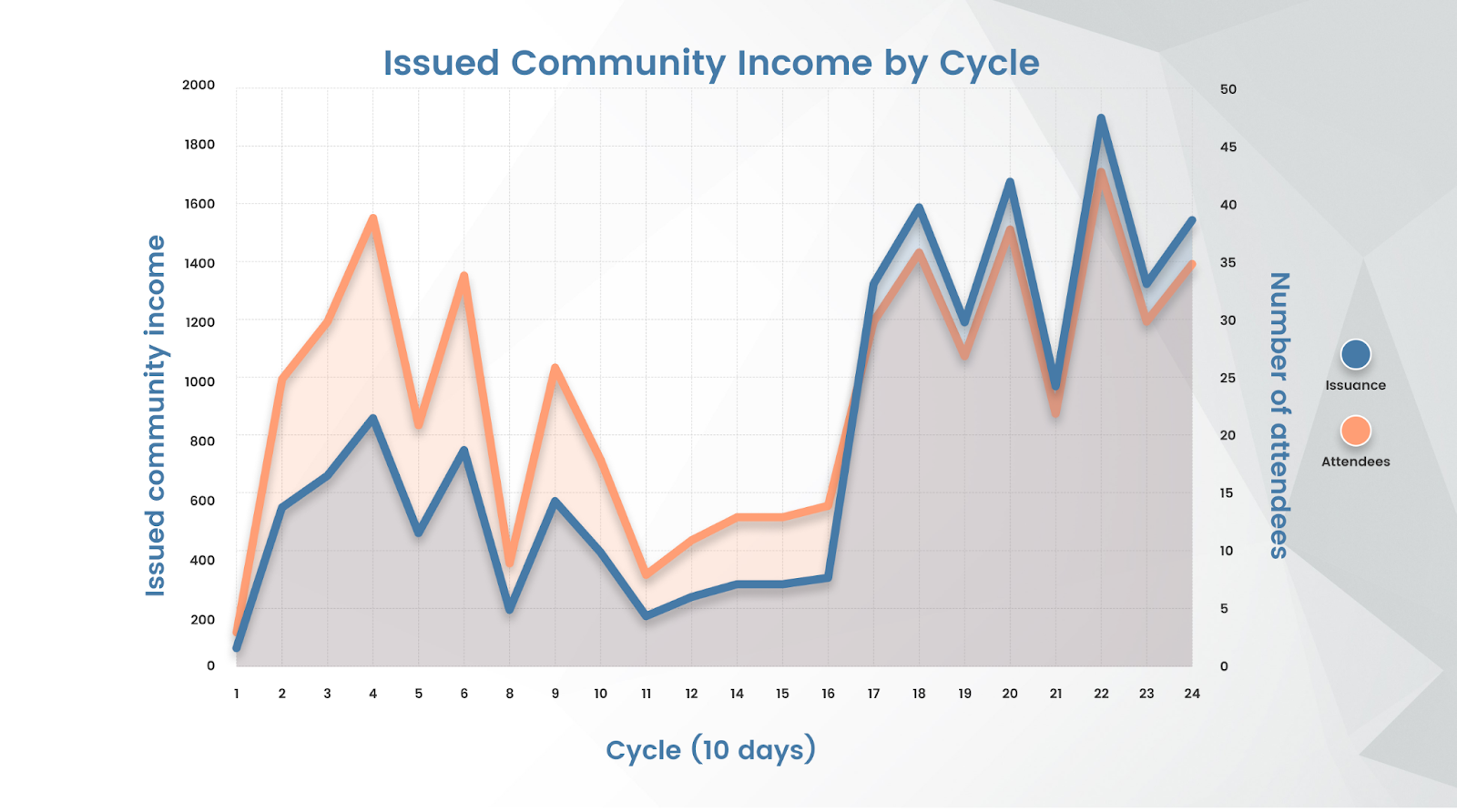

Anyone in Zurich can download the Encointer Wallet App and apply to claim a Leu community income every 10 days by attending a key-signing gathering. In the Leu community, these 10-day time periods are called cycles. At each gathering, participating Leu members meet at a specified location and time and confirm each other’s attendance by scanning a QR code in the app. The community income is currently set at 44 LEU, with the value of the currency pegged to the Swiss Franc.

New Leu can only be issued at key-signing gatherings, but keep in mind that there are two other ways to obtain it. Firstly, local businesses and individuals may choose to accept the currency for the goods and services they render. In addition, people can also directly purchase Leu with Swiss francs at designated locations such as Bar Sphères and events such as LeuTräff.

The chart below shows the number of Leu that has been issued and the number of attendees at each gathering. As would be expected, the amount of Leu issued correlates quite closely with the number of participants. One thing to note is that the attendance at the first six gatherings was largely dominated by friends and family of the initial bootstrapping members. After a lull during the summer holiday season, attendance grew notably at the 17th gathering, which coincided with a decision to raise the community income from 22 to 44 LEU.

The Encointer community uses an in-built reputation system to create a web of trust among community members. Each participant who successfully attends at least one key-signing gathering is considered to be “reputable”. Reputable participants can lose their status in two ways, however. Firstly, if they register to attend a gathering but do not show up, their account will be demoted to “newbie” status. In addition, if they earn reputable status by successfully attending one gathering but do not attend any of the five subsequent gatherings, their account will also lose its status. The number of gatherings during which a participant can retain their status without attendance is known as the reputation lifetime.

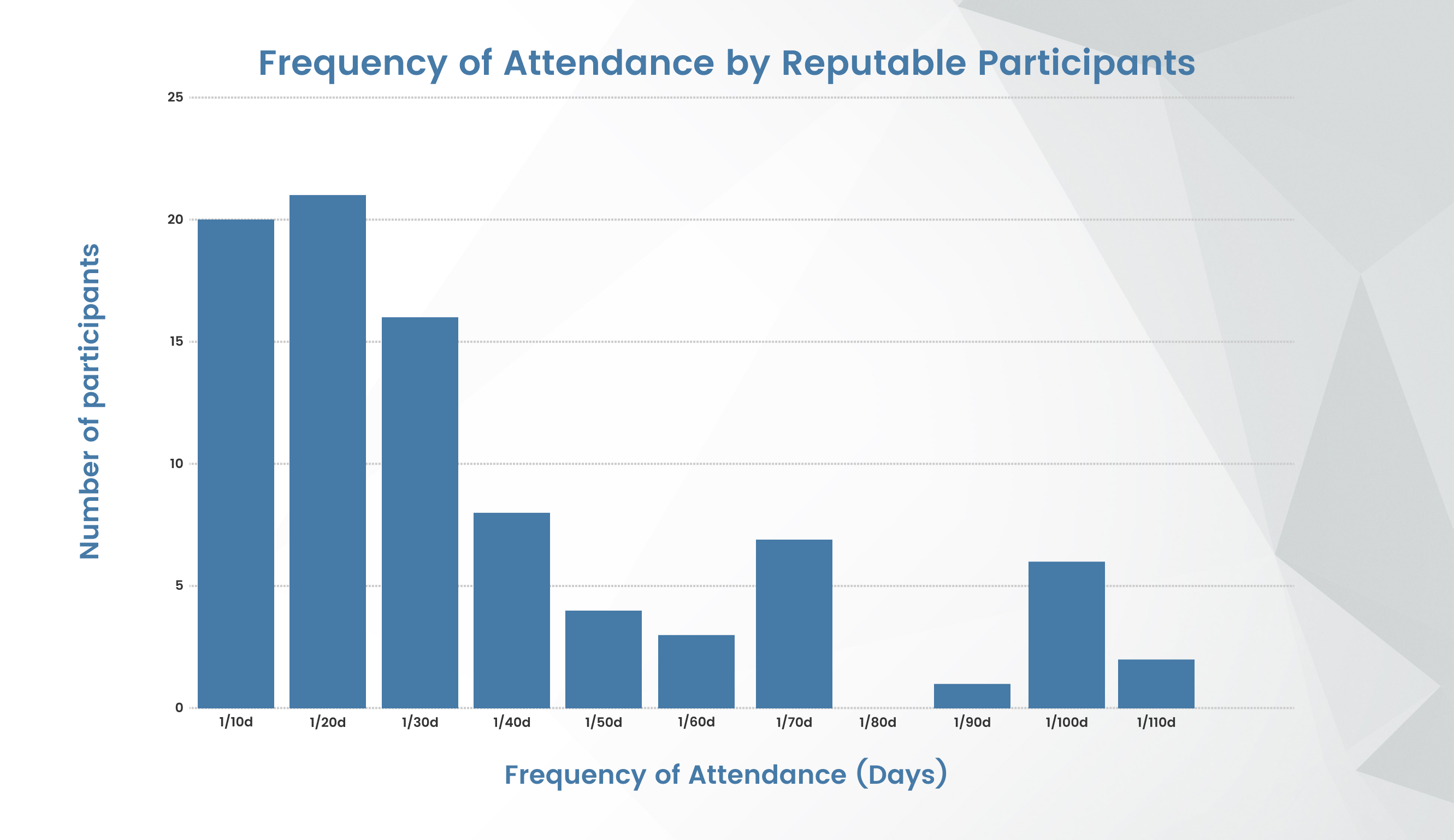

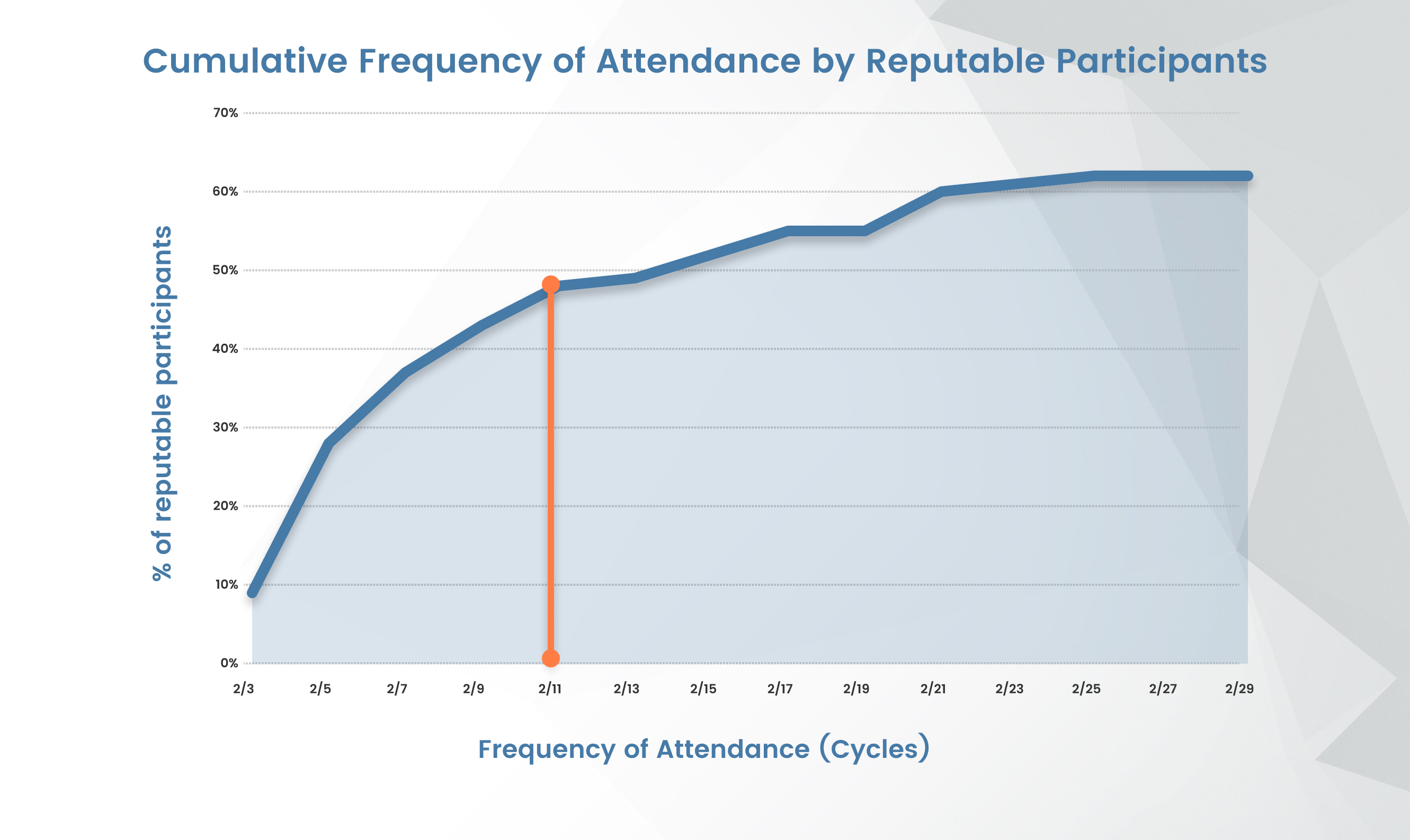

Observing attendance behavior can help us get ideas for how to fine tune the protocol to better meet user needs. By looking at how often people attend, it can provide an indication about whether the frequency of gatherings should be altered. In addition, it can also provide data to inform decisions about adjusting the reputation lifetime of user accounts.

Figure 2 below shows that 20 reputable participants at the core of the Leu community have attended almost every cycle after the first one they went to.

Of course, not everyone has the opportunity or inclination to attend every gathering, however. Figure 3 looks at all participants who classify as reputable and examines how often they attend. The data shows that 10% of reputable participants go to at least two of every three gatherings, while 27% attend at least every second gathering. Finally, 50% attend every sixth gathering or less, meaning that they fail to retain their reputation status and do not support community growth. This includes anyone who has attended only once so far.

Money supply and circulation

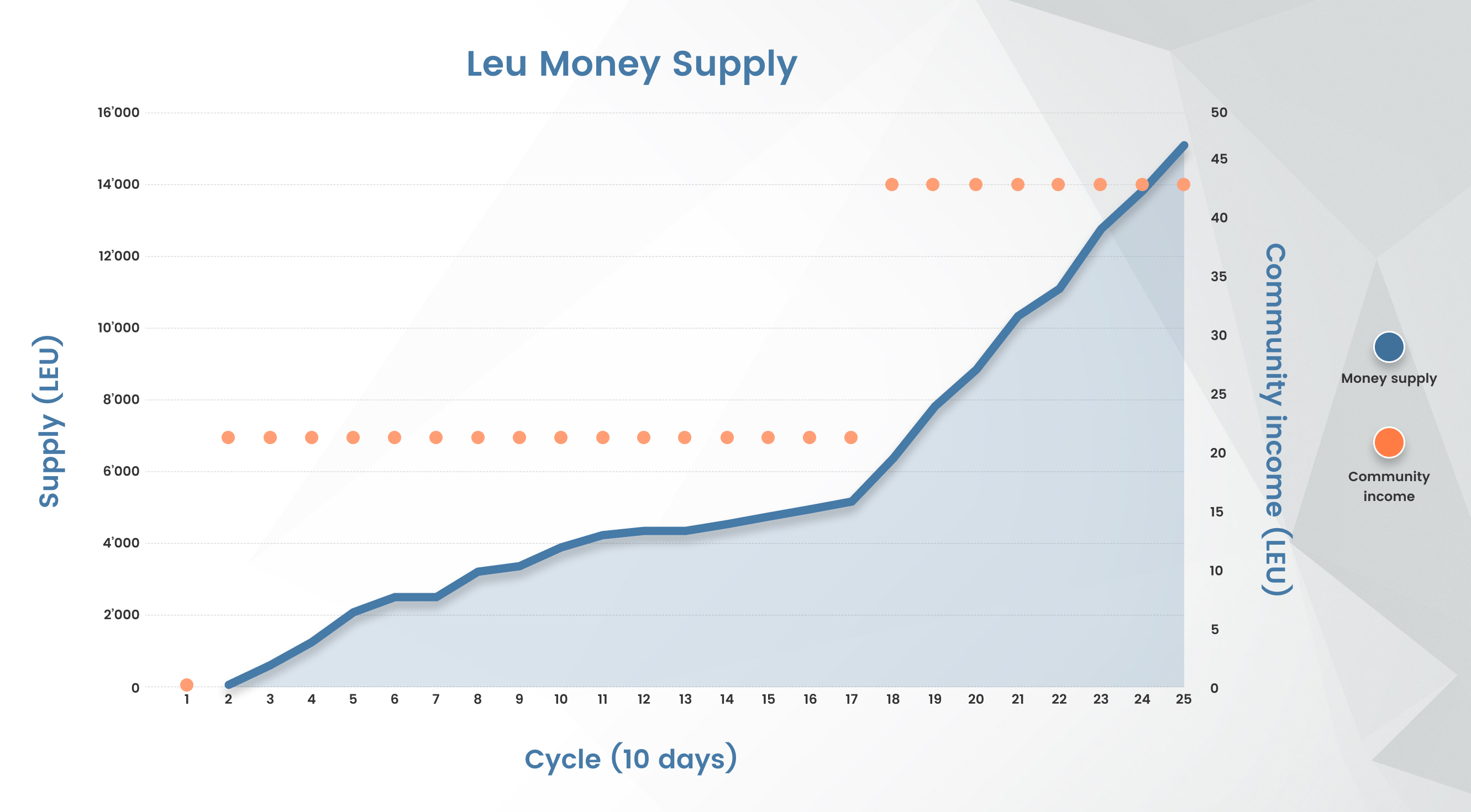

All Encointer currencies are subject to demurrage, which reduces the value of unspent balances in all wallets by a fixed percentage each week. Community currencies are all about stimulating local economic activity and this mechanism is designed to encourage spending rather than hoarding of the currency. The Leu community has set the demurrage rate at 1.35% per week. The total amount of an Encointer currency in circulation will expand so long as the amount of new currency issued at each gathering exceeds demurrage deductions. As can be observed in the graph below, the total money supply has grown to reach 15,025 LEU in total at the 25th gathering.

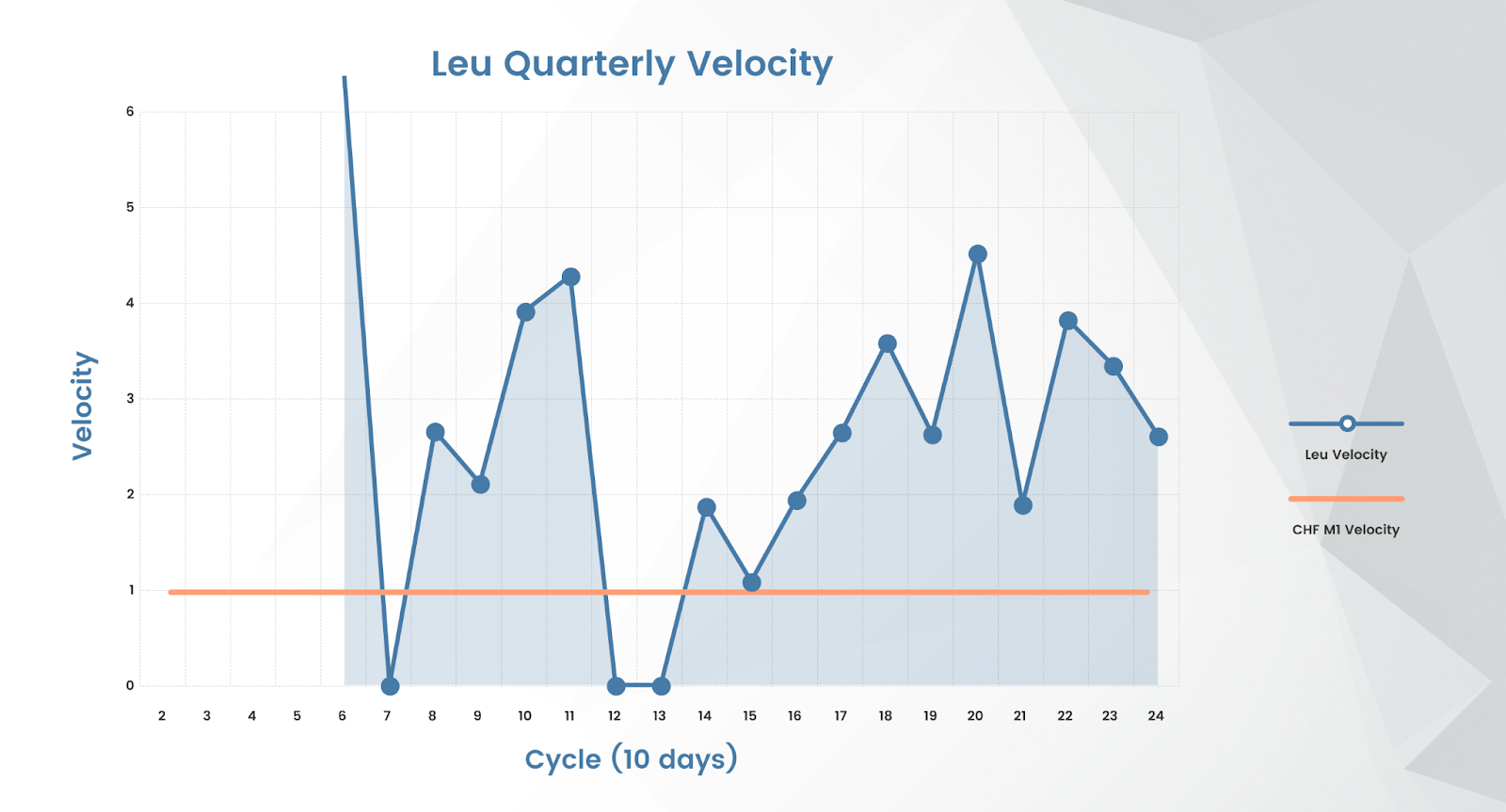

Any currency is primarily intended to be a means of exchange and Encointer currencies are specifically designed to incentivize local consumption. Thus, in addition to total supply, it may be instructive to examine how much Leu is circulating between community members. Velocity is a measure of how often a currency changes hands over one year. The graph below illustrates the velocity of Leu compared to the velocity of the M1 supply of Swiss francs, which encompasses both cash and CHF deposits in current accounts. Note that the early cycles prior to the seventh are not representative due to lower participation and that 7 and 13 show no turnover because they were administrative cycles which occurred in order to fix technical issues.

Overall, Leu tends to have a higher velocity than Swiss francs, with the most recent value being 2.62 for Leu, compared with .97 for CHF. Higher velocity is to be expected and broadly in line with the experience of other complementary currencies. Despite a comparatively high demurrage rate, however, Leu has not yet reached velocity levels that compare with the most successful complementary currencies like the Chiemgauer or Palmas.

In theory, this might indicate that either more participating businesses that accept Leu are needed or that money supply is higher than necessary. We will continue to monitor Leu velocity to help inform any future decisions on the value of the community income and to assess Leu’s effectiveness as a transactional currency.

Transaction Activity

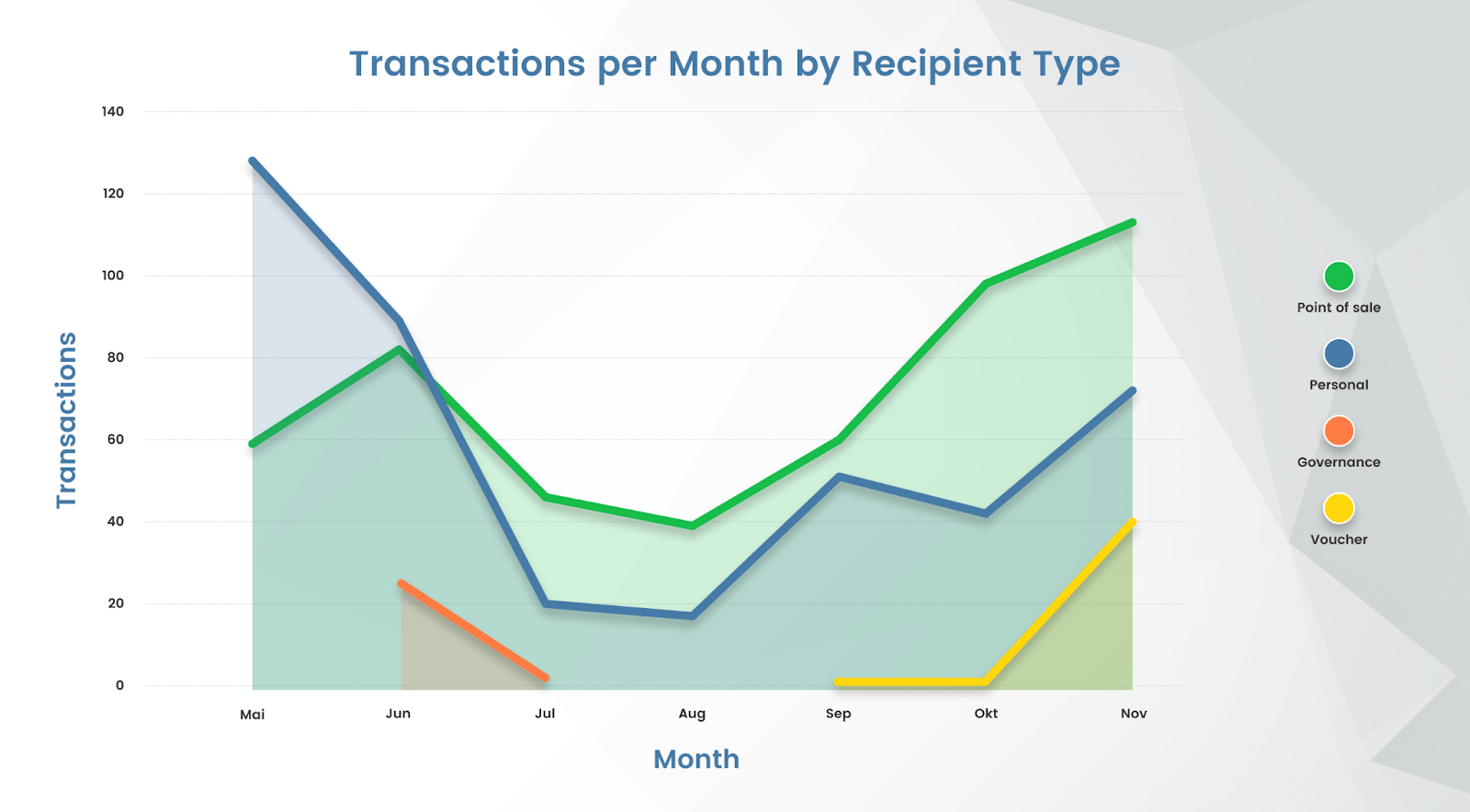

Another way to measure how much a currency is being used is to look at transaction activity. Transactions peaked in June at 200 before slumping during the traditional summer holiday season in August to 58, and then rising again to 231 in November. The peak figure in June was likely to have been bolstered by Openair Wipkingen, which took place on the 17th and 18th of that month.

Although the transaction numbers have increased since the low point in August, they remain modest with reputable community members only transacting one or two times per month on average. As discussed above, it is likely that transaction numbers will increase as the number of participating businesses expands. Another way to incentivize transactions would be to increase the demurrage rate, but at 1.35% per week, it is already set relatively high compared to other local currencies.

Examining transactions by category of recipient, it can be observed that the majority since July have related to purchases of goods and services from participating businesses at points of sale, followed by personal payments.

A smaller share of transactions relate to governance processes and the issuing of vouchers, which collectively account for 8% of total transactions. Since launch, 389 vouchers have been issued with a combined value of 402 LEU. Since then, 70 different individuals have redeemed 135 of these vouchers, which were worth 132 LEU in total.

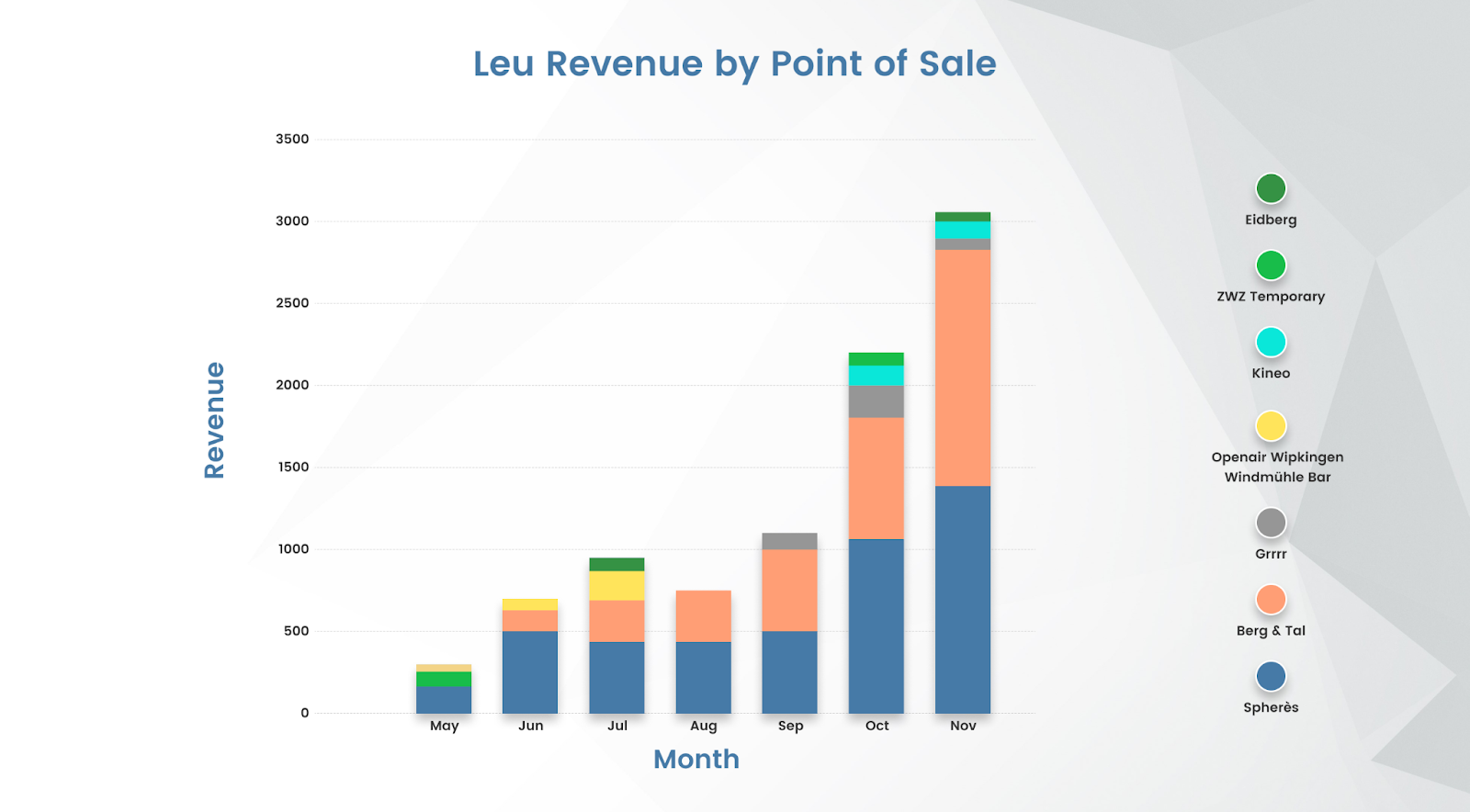

While the number of transactions is an important indicator, it does not give a sense of the size of those transactions. In this regard, it is useful to examine the turnover in Leu of participating businesses. While increasing Leu turnover is one of our goals, however, the overall objective is to increase LEU turnover without decreasing revenue in Swiss francs. This could arise, for instance, if a new customer frequents a store that they would not otherwise be aware of because it is listed as a participating retailer.

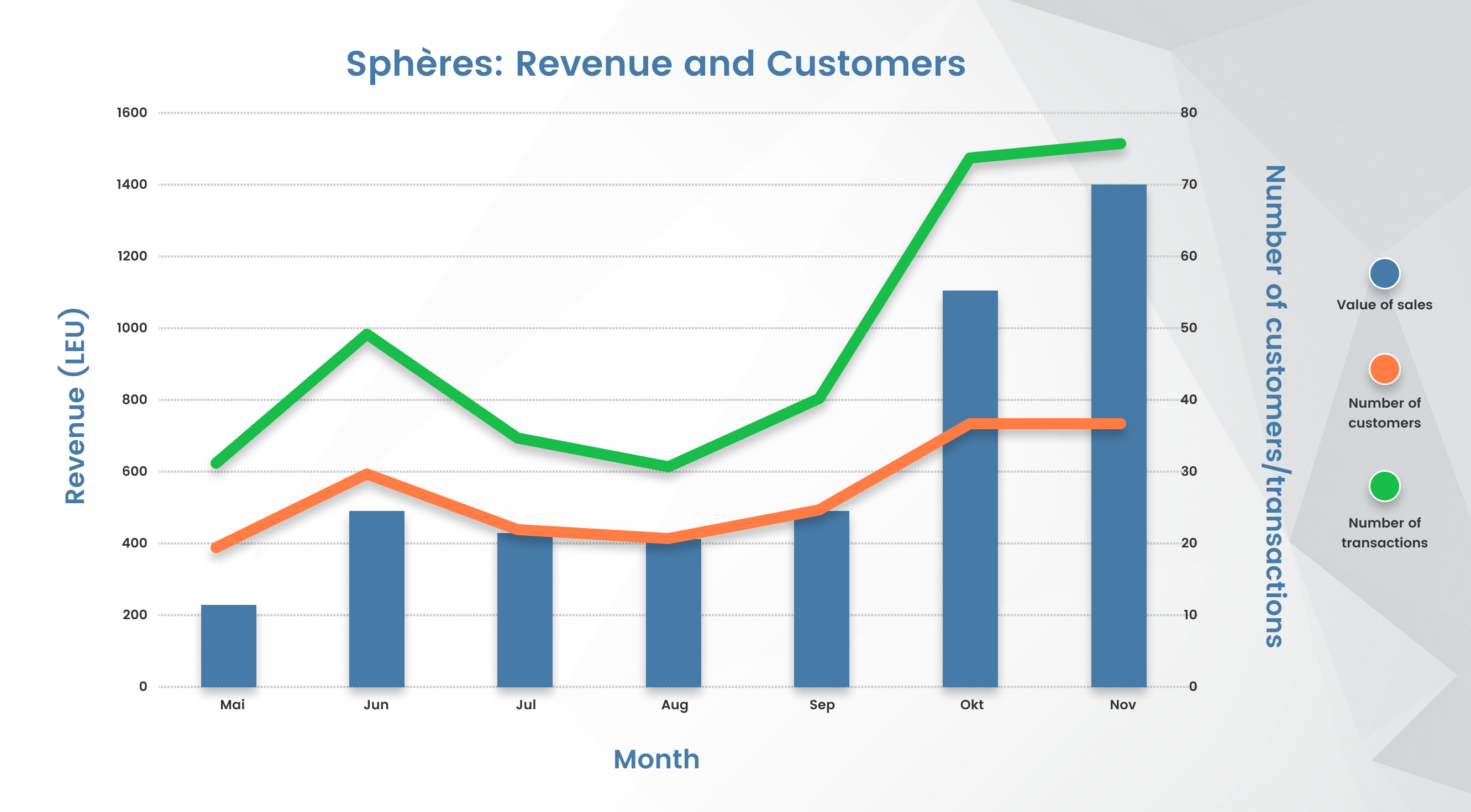

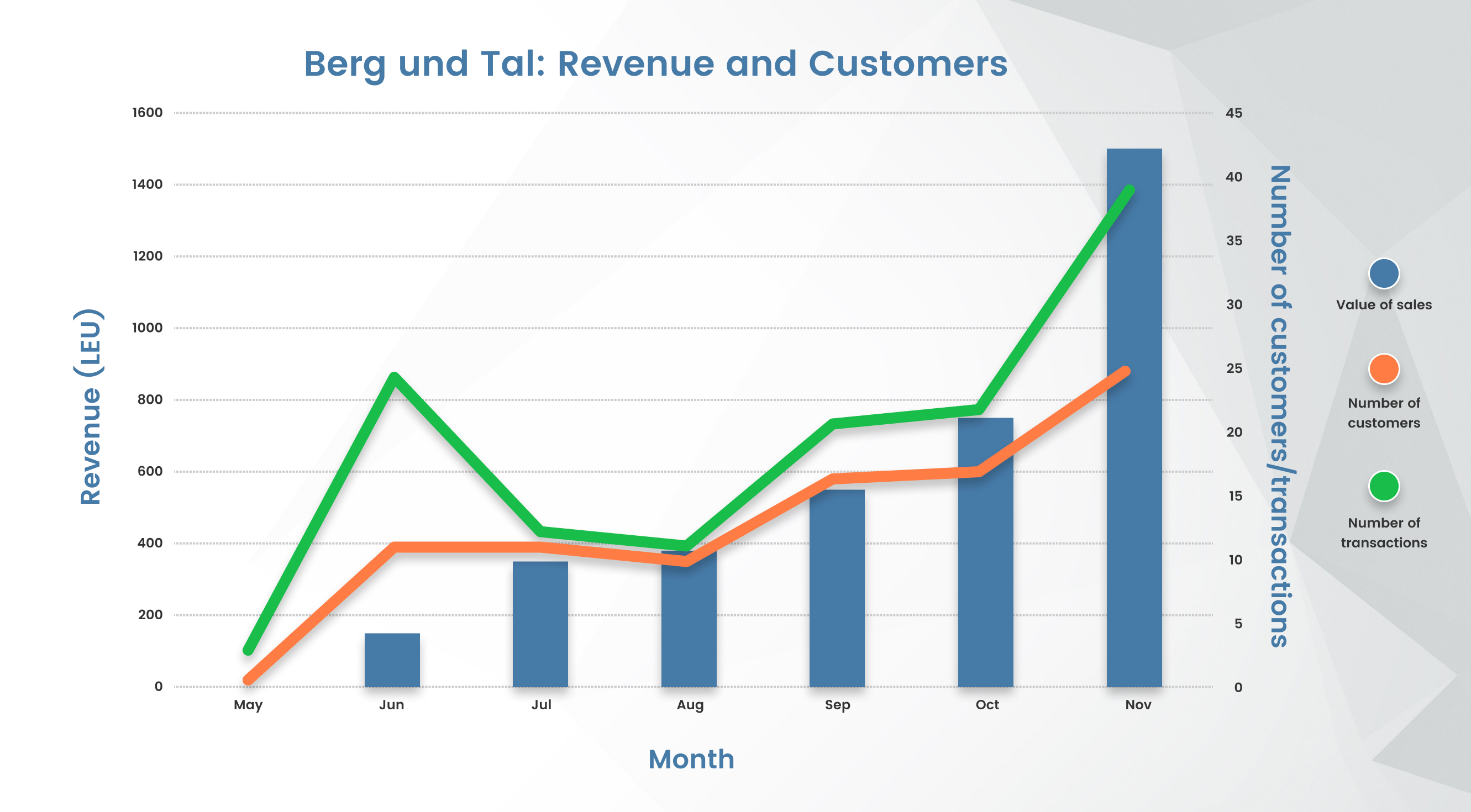

The bar chart below illustrates that the majority of Leu transactions have been conducted at two points of sale, Sphères and Berg und Tal. Sphères is a local bar and bookshop that was one of the first participating businesses and has hosted some of the “LEUträff” community meetups where issues relating to Leu and local currencies are discussed. Berg und Tal is a specialty food shop offering sustainable produce from the region.

Examining Sphères and Berg und Tal a little deeper, both experienced record Leu turnover in November, amounting to 1396 and 1495 LEU respectively.

At Sphères, 98 separate accounts have transacted at the point of sale on 332 occasions in total since May. In the most recent month on record, November, 75 different people consumed goods worth an average of 19 LEU. In addition, 32 people have bought a total of 423 LEU with Swiss Francs at the bar, which equates to an average purchase of 13.2 LEU per person.

In Berg und Tal, while the overall value of total Leu purchases has been similar to Sphères, the number of transactions has been smaller. This indicates that transactions tend to involve higher value items. Since June, 50 different individuals have purchased items on 128 occasions. In November, 25 different individuals purchased goods with an average value of 38 LEU each.

Conclusion

Since launching in May, the progress made by Leu Zurich is highly encouraging and clearly demonstrates that with the right execution and local support, Encointer is a viable model for creating fully functioning community currencies. The data shows that an enthusiastic and committed group of core members play a vital role early on and drive further community growth. One noteworthy challenge for Leu is that although transaction activity is on a clear upward trend since August, it remains relatively modest. We will need to analyze transactional indicators over a longer time frame when the network of participating businesses has expanded further to make any firm conclusions here. In addition, it will be interesting to observe any differences in the experience of Encointer community currencies in developing countries, where the community income will likely represent a larger proportion of the disposable income of participants and be used more for daily necessities. Encointer currencies have a number of in-built incentive levers at their disposal to reach their desired outcomes. These include adjusting the size of the community income payment, the frequency of cycles, the demurrage rate, and the reputation lifetime of accounts. We will continue to measure and analyze indicators and incentive levers on a regular basis to help inform the decision-making of Leu and our other Encointer communities globally.