European countries are often assumed to provide a good standard of living for all citizens. But the real picture is more troubling.

In economic comparisons between continents, Europe is frequently touted as the ideal, and indeed the data shows that wealth distribution on the continent is broadly better than its counterparts. But viewed over time, inequality in Europe is on the rise. Furthermore, while overall inequality in the region may be comparatively low, national and even regional disparities can be far more significant.

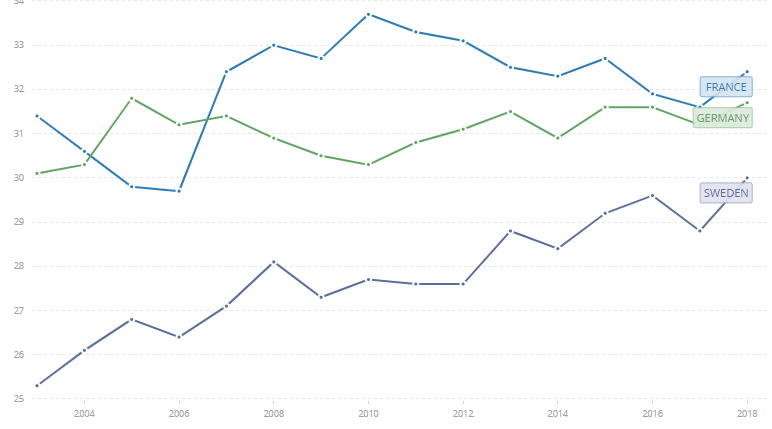

The Gini index measures inequality by quantifying the extent to which the distribution of income or consumption within an economy deviates from a perfectly equal distribution. A higher Gini index is a stronger signifier of inequality. According to World Bank data, the Gini index in several major European countries has been on the rise over recent decades.

In the UK, the most pronounced rise in inequality occurred during the deindustrialization and deregulation of the 1980s, with the Gini index rising 26 percent in the period between 1979 and 1991 – around the same level it has today. Inequality did climb further after that but dropped back after the 2008 financial crisis.

However, in other major European countries, the Gini index has risen in recent decades. For example, according to World Bank data (see above graph), Germany witnessed a 5 percent rise between 2003 and 2018, which is the most recent available data. France saw a similar net increase over the same period.

Perhaps most surprisingly, Sweden, a country with a history of very low levels of inequality and high rates of redistribution, experienced a sharper increase in the Gini index – 18.5% – over the same 15-year period.

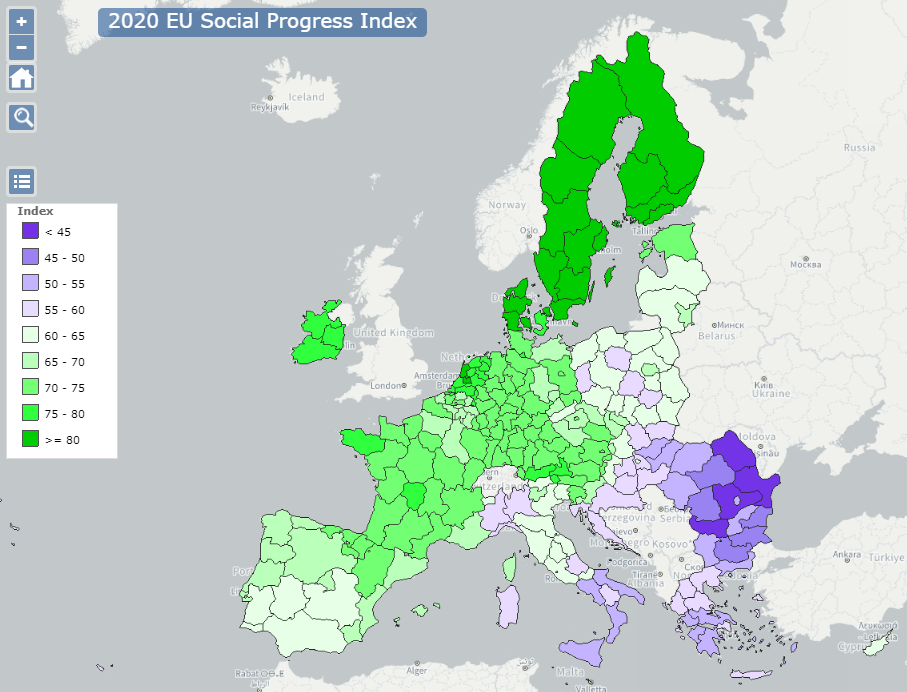

Across Europe, levels of inequality vary by region, but Southern and Eastern European countries face the highest rates.

Why does it matter?

Inequality has wide-ranging economic and societal consequences, hampering progress. While the interactions between economic growth and equality are complex, many studies have highlighted the potential negative effects of inequality, such as growth volatility. And beyond GDP, countries in Southern and Eastern Europe (which, as mentioned, score higher for inequality) also tend to score lower on the European Social Progress Index (see below), a measure of societal development and quality of life.

In addition, more unequal societies tend to be more susceptible to political instability and populism.

Geographical disparities

Patterns of inequality are also evident, particularly across the larger European economies. Income and employment in Europe are often geographically concentrated in larger metropolitan areas. This disparity leads to economically marginalized communities further out, which exhibit higher rates of unemployment and outward migration and enjoy less trust, economic connectedness, and social capital. In turn, this makes it more difficult for people there to form the human relationships and networks critical to achieving upward income mobility.

France, the United Kingdom, and Italy are all examples of countries with a stark geographical divide in the distribution of income, opportunities, and inequality. The conclusion of a 2021 study published by French statistics institution Insee makes reference to France being “bisected by a diagonal line running from Calvados to Gard; since World War II, the ‘winners’ have often been situated on the south-west side of this line, while the ‘losers’ have been located on the north-east side.”

In Italy, the north-south economic divide is well documented. A 2021 survey that divided Italy into four economic categories found that unemployment was as much as six and a half times higher in the poorest areas of the south than in the wealthiest areas in the affluent north. Investment in social care can be as much as 27 times lower in the most deprived areas than in the highest.

However, the UK appears to be among the worst performing when it comes to inequality, with a very strong concentration of wealth in the south of the country. According to The Economist, in a 2020 study that used 28 different measures of inequality to compare wealthy economies, the UK was above average for geographical inequality on all 28 measures and was top of the list for six of them.

This tends to result in liquidity shortages in disadvantaged regions – that is, not only generally depressed economies, but a lack of immediate spending power that holds local communities back. These marginalized communities often depend on seasonal industries like tourism or agriculture, resulting in liquidity droughts during periods of low demand. And gig economy workers, or those who rely on informal self-employment, must contend with low pay and income fluctuations. Again, this problem is greatest in the most deprived regions, and reinforces that deprivation.

Tackling the challenge

Inequality is undoubtedly a complex issue that requires a broad policy response. However, local currencies offer a way for communities to increase liquidity at a local level and improve their resilience. Encointer currencies are intended to be complementary, working in tandem with regular money. When participants can cover some of their basic needs and daily expenditure using their Encointer community income, their effective purchasing power is increased, so they can save more of their fiat income or use it for other purposes.

A study by Damla Welti, a postgraduate scholar at ETH Zurich, used an agent-based model to simulate the effect of Encointer community currencies in low-income communities. The results indicate that the introduction of Encointer currencies could enable participants to save a higher proportion of their fiat income, resulting in greater equality in terms of purchasing power.

Without the influence to change global policy, Encointer empowers communities that may be the worst affected by inequality with a straightforward, user-friendly financial tool that can improve their situation. Furthermore, the benefits of Encointer only increase with greater adoption, since retaining money in local communities prevents the so-called “leaky bucket” effect.

Beyond the financial benefits, Encointer also enhances community cohesion by promoting participation in a mutually beneficial shared initiative and requiring regular in-person meetups to claim individual allowances of the local currency. For local merchants, there are many benefits to adopting Encointer currencies as a complement to existing payment methods.

To discover more about how Encointer works and how it could benefit your community, visit our homepage, or contact us for an initial discussion about launching an Encointer currency.